About Us

Syndicate Management

Investing at Lloyd's

tax-corporate-services

News

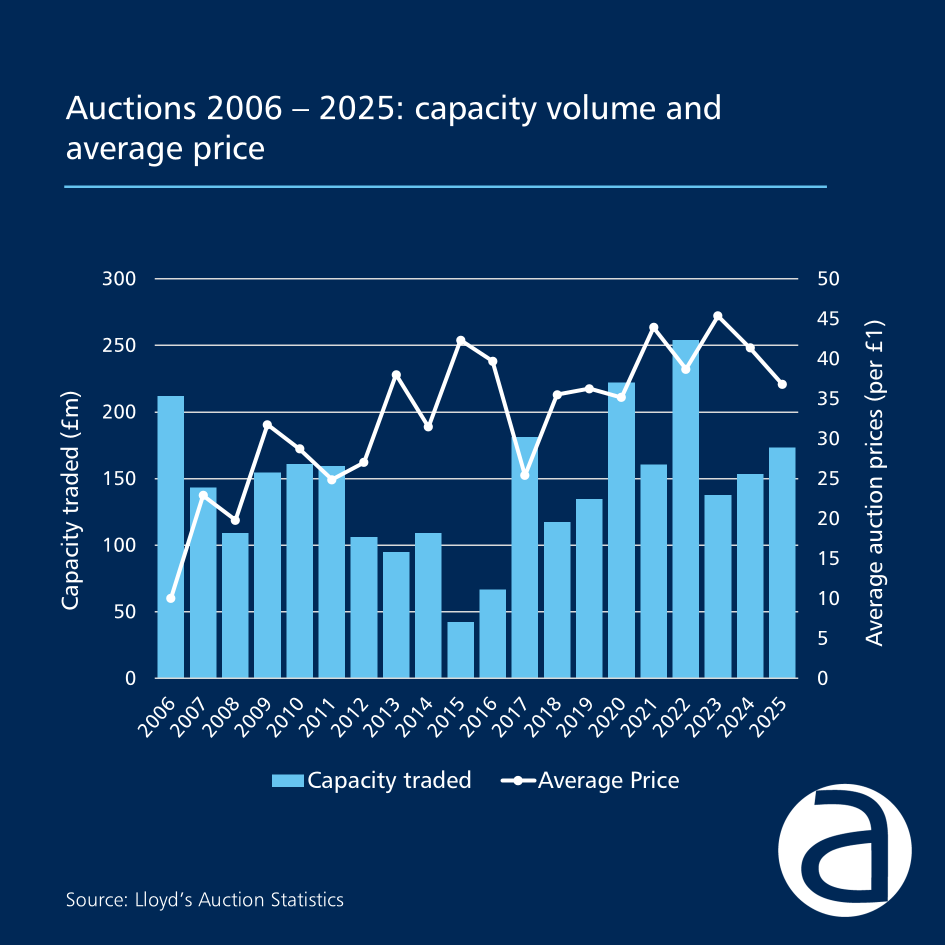

While many people see Lloyd’s of London as a slightly mysterious building filled with brokers and underwriters dealing in insurance, behind the scenes each autumn another, quieter (and often difficult to understand) marketplace takes centre stage for three consecutive weeks, the Lloyd’s syndicate capacity auctions.

It’s an odd corner of the City, where investors buy and sell slices of insurance syndicates (not policies or shares), but the right to take part in writing business for the coming year; while it’s largely unknown to the public, the amounts transacted run into hundreds of millions of pounds.

To provide some background knowledge, every syndicate at Lloyd’s has an agreed underwriting limit, called its capacity, that defines how much insurance it can write in a year. This capacity is owned by investors, who are known in Lloyd’s language as members or Names.

Each autumn, Lloyd’s runs three online auctions where these members can sell capacity they no longer want, and others can buy more if they fancy a syndicate’s prospects. The process doesn’t change the syndicate’s size, just who owns what portion of it.

In effect, it’s the insurance market’s version of a stock exchange, but instead of trading shares, the participants are trading underwriting rights.

Participants are a mix of private investors (the traditional “Names”) and large corporate members, along with the actual syndicates (Managing Agents) themselves who sometimes want to acquire a greater amount of their own (aligned) capital where perhaps they are seeking to consolidate capacity on the syndicates they run.

Some of these are looking to increase their stake in a well-performing syndicate, whilst others want to reduce their holdings, cash out, or rebalance their portfolios. For new investors, the auctions can represent the beginnings of their portfolio, and a chance to acquire a part of a syndicate or syndicates if the perception is that they will perform well.

The three auctions held in 2025 took place on the 23rd and 30th October, and the 6th November.

The first auction usually sees the biggest level of activity. Approximately £86 million worth of capacity changed hands across multiple syndicates, which was the largest volume of the three rounds. The first auction is generally when big strategic moves happen with buyers targeting syndicates with strong underwriting records, while others exit those they see as underperforming.

This first auction was no different and showed robust demand for syndicate capacity, with increased volumes across tenders (sales), subscriptions (purchases), and successful trades compared to the same stage in 2024. Specifically, Beazley Syndicate 623 emerged as the most actively traded, executing a strategic shift in its bidding approach.

Initially offering £30 million at 25.1p, Beazley later raised its bid to 52.5p and acquired all £15.5 million of traded capacity, increasing its ownership to nearly 77%.

This move triggered a mandatory offer (required once a Managing Agent owns more than 75% of the total syndicate capacity), expected to be fulfilled in 2026.

Beazley’s total bid of £250 million suggested it would continue to participate in the second auction. The price increase by Beazley allowed them to outbid approximately £8 million of third-party interest that would otherwise have succeeded. This shows how different bidding levels can be successful or thwart what might otherwise be seen as competitive offer levels.

NormanMax Strategic Parametrics, aligned with Syndicate 3939, secured capacity at the minimum price of 0.1p, bringing its ownership to 98.2%. Most non-aligned sellers opted to sell this syndicate, although three tranches totaling £107,000 remained unsold due to higher reserve prices. Atrium Syndicate 609 traded at an average of 40p, marking its lowest level since 2012. The wide spread of successful bids (from 11p to over 65p) meant sellers received a weighted average, and based on this, the consensus is that pricing would stabilize in the remaining two auctions.

Three syndicates traded for the first time: Convex 1984, Oak 2843, and Volante 1699. Convex led the group with £7.5 million traded at 8.6p, while Oak traded at 0.7p despite a 125% pre-emption, and Volante saw just £100,000 traded. These new entrants operate under modified evergreen agreements, requiring members to support the syndicate if their capacity is unsold. Fidelis 3123, part of this cohort, saw its auction price fall from 27.7p in 2024 to less than 1p, aligning with market expectations.

The influx of new syndicates and free capacity contributed to a five-year low in Argenta’s capacity value price index, which tracks the average cost of building a portfolio.

The index reflects the changing composition of syndicates supported by individual members, including vehicles such as Beazley 5623, Ada 2024, Beat 4242, and Special Purpose Arrangements (“SPAs”) like MAP 6103 and Hiscox 6104. Lancashire Syndicate 2010, now fully aligned following its June capacity offer, is excluded from the index going forward.

Premium syndicates continued to command high prices. Chaucer 1176 (nuclear) traded above £2/£1 for the 14th consecutive auction, with a record £450,000 volume. Asta 2525 maintained its streak of trading above £1 for the eighth time, while Meacock 727 remained consistently priced between 90p and £1. MAP Capital sold £250,000 of Syndicate 2791, with £1 million unsold at a £1/£1 floor. Despite this, pricing rose 3% from 2024, with demand exceeding supply by a ratio of 2:1. Hiscox 33 showed similar dynamics, with prices up 2% and a buyer-to-seller ratio of 1.75:1. The syndicate is pre-empting for 2026.

Overall, this first auction reflected a dynamic and competitive environment, with strategic bidding, evolving syndicate structures, and strong investor interest shaping the landscape ahead of auction two.

The second auction, held the following week, was calmer but still involved a fair amount of activity. Around £47.7 million of capacity was traded, representing roughly £15.9 million in cash value. Buyer interest far outweighed supply, with offers to buy totalling nearly £370 million – a sign of confidence in Lloyd’s as an investment, even amid UK and global uncertainty.

The second Lloyd’s capacity auction of 2024 saw a notable decline in activity compared to the first, with reductions in tenders, subscriptions, and traded capacity. This pattern aligns with the historical trend of the first auction being the most active, typically accounting for over half of the annual traded volume. Prices rose in the second auction, and with more information available, particularly on unsatisfied bids from the first auction, participants were better positioned to target their offers. Notably, non-aligned buyers, having been out-manoeuvred by Beazley’s price increase on day two of the first auction, responded assertively and secured nearly half the available capacity in the second. Beazley itself added £7.8 million to the £15.5 million acquired previously, maintaining its bid at 52.5p.

Beazley remained the only significant aligned buyer. NormanMax Parametrics continued its consolidation of Syndicate 3939, purchasing an additional £183,000 to bring its total to £10.4 million, leaving just 1.22% (£366,000) in non-aligned hands. Volante Syndicate 1699, which had a single buyer in the first auction, saw no interest in the second, with £18 million now expected to revert to the managing agent. Argenta appeared to bid for its own capacity on Syndicate 2121, again offering £20 million at below 1p (a level far from the market) where no bids below 15.6p were successful.

Atrium 609, which had been a bargain in the first auction with low double-digit bids, saw a pricing floor emerge in the second, with no successful bids below 40p. TMK 510 may have filled the value gap, with some buyers acquiring capacity below 40p despite a published price of 52.6p. Demand remained intense for high-performing syndicates. Tony Ive’s Syndicate 2525 attracted over £2 million in bids for just £29,000 of available capacity. Meacock 727 saw £4.8 million in demand for £100,000 on offer.

MAP Capital’s £1 million parcel of Syndicate 2791 capacity remained unsold for a second auction, with only sellers at 89p or below able to transact. Among the new syndicates operating under modified agency agreements, Convex 1984 stood out as the most popular. It saw its price edge up to 9.0p, with six buyers each acquiring over £100,000. In contrast, Fidelis 3123 and Oak 2843 had unsold capacity at the minimum price of 0.1p. Apollo Syndicate 1969 was another standout, with all buyers (including those bidding at 0.1p) fully satisfied despite a 4% increase in the listed price to 3.8p.

The third and final auction in early November wrapped up the season. This last round is typically smaller, used to tidy up portfolios and make minor adjustments before the window closes. Once the auction closes, investors know exactly what they’ll hold for the 2026 underwriting year.

This was the smallest in terms of volume but the most expensive in terms of average pricing. Despite this, intra-auction price movements were relatively muted compared to previous years. The five most prominent syndicates (Hiscox 33, TMK 510, Atrium 609, Beazley 623, and MAP 2791) each saw only single-digit price changes. These syndicates represent approximately 55% of Argenta members’ capacity holdings, contributing to the overall stability of the price index across all three auctions.

The price index remained largely unchanged throughout the auction cycle and is down compared to prior years. This index incorporates limited tenancy syndicates and reflects the impact of newer vehicles such as Beazley 5623, which, due to their scale and pricing, help suppress the overall index. A key influence this year was the introduction of the three new auction syndicates, Convex 1984, Oak 2843, and Fidelis 3123, all operating under modified agency agreements and offering substantial pre-emption.

As expected for new entrants, pricing was modest. Convex 1984 performed best among them, averaging 8.5p across the auctions, although its price declined in the final round. As these syndicates mature and build trading records and reserves, their auction pricing is expected to strengthen.

Beazley 623 was again the most actively traded, with its aligned vehicle increasing its stake further. Beazley acquired £35 million of capacity over the year, accounting for 20% of all traded capacity. The firm is now seeking a waiver of its renewed obligation to make a mandatory offer to syndicate members, with a vote on the proposal to follow. Fidelis 3123 was the second most traded syndicate, with a £10 million block acquired by a single institutional but non-aligned buyer. HRP Syndicate 2689 ranked third, with 6% of its total capacity traded in the final auction and over 20% across the full auction cycle.

MAP Capital’s attempt to sell capacity on Syndicate 2791 was unsuccessful, with a £1 million block remaining unsold at a £1/£1 reserve in all three auctions. MAP Capital was absent from the ‘connected sellers report,’ supporting the assumption that no trades were completed.

At the lower end of the pricing spectrum, bidders offering the minimum price of 0.1p were able to secure capacity on Apollo 1969, Convex 1984, HRP 2689, and Fidelis 3123. However, some capacity tendered at this level remained unsold. Traditionally, this capacity would be returned to the managing agent through the drop process. In contrast, the modified agency agreements on these newer syndicates preclude the drop, meaning unsold capacity will instead be capitalised by the original seller.

These auctions might sound niche, but they serve an important purpose. They keep the market liquid and transparent, allowing investors to enter or exit positions easily. Prices from the auctions also provide a snapshot of sentiment, including which syndicates the market views as strong bets for the year ahead.

A high price in the auctions usually signals confidence in that syndicate’s management and performance. A lack of bids might indicate weaker expectations or recent losses.

Lloyd’s itself encourages the process: it keeps capital flowing to well-run syndicates and ensures investors’ money is working where it’s most productive.

For those outside the insurance world, it can be hard to grasp just how unusual this is. Nowhere else do investors buy and sell the right to take insurance risk like this. It’s part of what makes Lloyd’s unique: a marketplace that finds ways to trade, invest, and evolve.

So, while most people never see it, the autumn capacity auctions are a vital barometer of confidence at Lloyd’s, and for the small group of investors who take part, it’s a season of strategy, speculation, and opportunity.

Argenta Private Capital Limited is authorised and regulated by the Financial Conduct Authority (No. 204845). Past performance and pricing does not guarantee future results. This analysis is conducted by our specialist research team and based on 2025 Lloyd's Auction Results.